Webinars

UBCM is pleased to introduce our first series of Group Benefits webinars for 2026. These sessions are designed to provide members with valuable insights and updates on key benefit topics for the year ahead.

We invite all interested participants to register using the links provided below. If you have any questions or require additional information about the webinars, please contact Rebecca Williams, HR & Group Benefits Officer

Disability management basics for leaders – Leading in sickness and in health (Part I)

Wednesday, January 14, 2026, 12 - 1pm – Register in advance

A leader’s initial response when learning about an employee’s health issue can significantly influence the success of the return-to-work process, including its duration, cost, and overall outcome.

Join Samuel Cervantes, MHA, CDMP, Senior Manager of Disability Client Relationships & Health and Wellness at Pacific Blue Cross, as he shares insights on how leaders can create supportive, productive return-to-work experiences. Topics include:

- The leader’s mindset: Supporting successful return-to-work outcomes.

- Timely return-to-work: How leadership can impact a timely return.

- The value of modified work: How flexible approaches can benefit both the employee and the organization.

Protecting and promoting wellbeing at work – Leading in sickness and in health (Part II)

Wednesday, January 28, 2026, 12 - 1pm – Register in advance

We spend up to a third of our waking lives at work, making the workplace a key influence on our health and wellbeing. People leaders play a critical role in shaping a work culture. A culture that energizes teams and gives work meaning can contribute to longer, healthier lives. Join Samuel Cervantes to explore how leadership directly impacts team wellbeing and workplace culture. Topics include:

- The leader’s role: exploring the surprising strength of our influence on each other’s health

- The GRPI model: How this team effectiveness model can protect health and safety

- Promoting Wellbeing: 6 tactics that can promote wellbeing in your workplace

Diabetes medication in BC: The current and changing landscape

Wednesday, February 18, 2026, 12 - 1pm – Register in advance

Diabetes is a leading chronic health condition and a Dr. Anar Dossa, Vice President, Pharmacy Services at Pacific Blue Cross, by exploring the evolving landscape of diabetes treatment and what it means for patients, providers, and workplaces. Topics include:

- National Pharmacare: starting March 1, 2026, eligible diabetes medications and supplies will be covered by National Pharmacare

- Mounjaro vs. Ozempic: Comparing America’s top-selling drug to other leading treatment options.

- Ozempic’s lifting patent: What it means for pricing and accessibility.

- Screening and prevention: Practical tips and guidelines to promote awareness, support early detection, and help prevent the progression from prediabetes to diabetes.

Bridging the gap on men’s mental health literacy

Wednesday, March 4, 2026, 12 - 1pm – Register in advance.

Men often face mental health struggles in silence due to stigma, shame, and outdated views of masculinity. Men account for 75–80% of suicides in Canada, leaving thousands of families and communities devastated each year. Join Joe Rachert from HeadsUpGuys for a powerful session that explores how we can better support men’s mental health. Topics include:

- Understanding the challenges: Why men often struggle to recognize, express, or seek help for mental health concerns.

- Spotting the signs: How to identify warning signs of depression and suicide risk in men and understand the barriers that keep many from seeking help.

- Taking action: Learn practical ways to show up for the men in your life.

- Exploring resources: Get an introduction to HeadsUpGuys.org, a free, anonymous, evidence-based resource supporting men’s mental health and recovery.

Articles

Periodically UBCM provides articles on relevant topics to affiliated newsletters. As a GFOABC Sponsor, we have the opportunity to submit articles to their quarterly newsletter. Below are the Group Benefits articles that you can also find in the GFOABC Dollars & Sense newsletter.

Ozempic, a medication used in the treatment of type II diabetes, has received widespread attention in the news as it has been touted as an effective drug in the treatment of weight loss. As a result, it is important for plan sponsors to have a general awareness of how it is used, its cost, and some best practices with respect to management, to ensure optimal management under your group benefit plan.

What is Ozempic?

Ozempic is a form of a semaglutide that is administered through a self-injectable pen. It regulates insulin and lowers blood glucose levels by mimicking a hormone in the body.The cost of the medication is approximately $300 per patient per month.

How has the Group Insurance Market Reacted to Ozempic?

Ozempic is an approved drug by Health Canada for treatment of Type II diabetes, and most group benefit plans in the market provide coverage for this drug if it is prescribed for this purpose. With few exceptions, members are required to go through a special authority process in order to receive approval to have this medication covered under their group benefit plan.If Ozempic is prescribed for off-label use such as for weight loss, then most group benefit plans will not reimburse the cost of the claim.

What Does the Future Look Like for Ozempic?

Plan sponsors should brace themselves for a wave of Ozempic-like medications which are expected to hit the market over the next 3-5 years. The first such drug, called Wegovy, was introduced to the Canadian market in May 2024. Wegovy was created by the same manufacturers as Ozempic and has a higher dosage of Semaglutide as compared to Ozempic. The Cost of Wegovy is approximately $400 per patient per month.Ozempic may have been the first semaglutide, but the expectation is that there will be a variety of these new medications hitting the market in the near term.

What Can Plan Sponsors do to Protect Against High Costs?

In British Columbia, we are fortunate that BC PharmaCare assumes a portion of Ozempic’s costs and also adjudicates the special authority process members are required to undergo in order to access coverage for this medication. Plan Sponsors in BC therefore should question their insurance providers to ensure the appropriate process is in place, and that members are not reimbursed from your plan in cases where the medication is administered for off-label use.Over the long term, Plan Sponsors may achieve more sustainable financial results from their prescription drug plan if they adopt a managed formulary, established and managed through their insurance carrier or aligned with BC PharmaCare.

The following article is highlighted in the GFOABC September, 2023 Newsletter.

In last year’s Federal Budget (“Budget 2022”) it was announced that a new Canadian Dental Care Plan (“CDCP”) would be rolled out. Details were scarce at the time, however, the scope and impact to employers has gradually been clarified.

Who is Covered and What Coverage is Available?

The CDCP coverage was originally rolled out in Bill 31 which reached royal assent in November 2022. The first stage was launched in December 2022 and coverage was offered as follows:

- A tax-free lump sum benefit amount per year per child under age 12 was provided, with the amount varying depending on annual household income ($650 for less than $70,000, scaled up to $260 for family income less than $89,999)

- Parent/guardian must attest that the child has no access to private Dental coverage and will have out-of-pocket Dental expenses

In subsequent updates provided through Budget 2023, the Federal Government announced that individuals under 18, seniors and persons with disabilities will receive coverage by the end of 2023, and eligibility will be expanded to all those who are eligible by 2025. The coverage will only be available to uninsured Canadians.

We expect the CDCP will have a limited impact on most group benefit plans for active populations, and will primarily impact retiree dental benefit plans and individual dental insurance markets as members may be eligible for, and opt to receive coverage from the CDCP instead of continuing their current coverage.

How Will This Impact Employers?

A key requirement for members to receive coverage under the CDCP is that they need to be uninsured for dental coverage. As a result, Employers will now be responsible for reporting their members’ eligibility for dental coverage on their T4/T4A reporting beginning in the 2023 tax year.

We recommend that employers consider the following as you prepare for this reporting:

- Employers and their insurance carriers should be ready to have a full listing prepared of all individuals who are eligible for coverage on December 31st, with further thought given to special circumstances:

- Ensuring that historical opt-outs and any special sub-groups (e.g., retirees and individuals on LTD with continuation of coverage) are included on this list

- Ensuring that waiting periods are considered

- Being prepared for member questions

- While it has not been shared within Bill C-47, it is our preliminary understanding that the new box added to the T4 is Box 45, while the new box added to the T4A is Box 015 (this may be subject to change).

We encourage plans to discuss this matter with their accounting/payroll resources to ensure a clear understanding of the specific format that information will be disclosed on T4/T4As.

Every group insurance program includes operating costs. Some examples of these activities are as follows:

- Claims adjudication according to the terms of the plan (typically an insurance carrier completes this function).

- An insurance carrier providing some element of insurance (varies depending on underwriting arrangement).

- Creating and maintaining plan documents (Booklets and Contracts).

- Service representatives to assist members and administrators with their inquiries (either through a broker or directly with the insurance carrier).

- Financial analysis of your plan for renewal rating purposes.

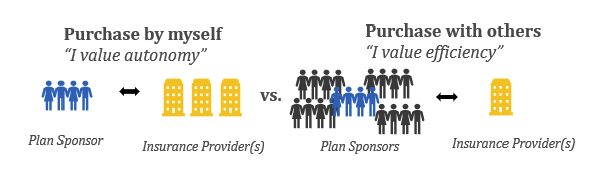

If you purchase coverage through a broker or directly with an insurance carrier, the total operating costs are funded by your plan on its own. These costs are sometimes added explicitly (for self-insured arrangements) or implicitly through the financial terms under your policy (for insured arrangements).

You can reduce the operating costs of your group benefit plan by working alongside other organizations and purchasing coverage through a pooled arrangement. By purchasing alongside other groups, you share operating costs amongst a greater member base, and ultimately reduce your plan’s portion through economies of scale. This strategy enables small and mid-sized organizations the ability to purchase coverage according to similar terms that are enjoyed by larger groups.

Image

In addition to reducing the operating costs under your plan, a pooled arrangement can also have the following advantages:

- Providers are more receptive to offering customized services due to the size of the existing contract. For example, the UBCM Benefit Plan has a Performance Standards Agreement with their insurance carrier (Pacific Blue Cross) which outlines the service timelines that their participating groups will receive under the Plan. Participating members therefore receive superior service that is measured and managed over time. These groups would not be able to obtain these terms on their own outside of the pool.

- A pooled arrangement can also provide access to subject matter experts such as pharmacists, actuaries, lawyers, and disability management experts. A Plan Sponsor could engage these individuals under broker or direct models, however, doing so under a pooled arrangement as part of a broader initiative helps to reduce costs given the fees can be spread out over multiple Plan Sponsors who have similar needs.

Pooled arrangements reduce costs over the long term. That being said, they are not a “one size fits all” type of arrangement and the following considerations should be noted before joining a pool:

- Under most pooled arrangements, the choice of benefits provider (i.e., insurance carrier) is determined by the sponsor of the pool and is not chosen by the individual groups.

- Transparency is a common concern in the group benefits industry, but this can be exaggerated in some private sector pooled arrangements. If you participate in a pooled arrangement and are not aware of the financial terms, you should ask to ensure you are aware of the general process as to how your premium rates are established.

Group Benefits Plan Newsletters

UBCM has shared Group Benefits Plan Newsletters highlighting important information and news articles about Group Benefits. Let us know if there is a topic you want to hear about.